Back in April of last year I wrote this:

We've been in a rather choppy market for the past 9 months which to me looks like a base. Bears of course are going to say it looks like a bear flag, but I will say this. If I woke up from a 5 year coma and the first thing I did was look at 5 year chart of the market, I'm pretty sure I would say that it looks like the market is consolidating gains from recent years and is forming a base which will lead to an upside breakout at some point. That would be an objective viewpoint based solely on market action without any biases or influences from news flow, economists, pundits and what have you.

I didn't see one single person on twitter or in the entire financial media make an observation along these lines. Instead, all you heard throughout 2023 were complaints about how the market was only being driven by 7 stocks (not entirely true) or warnings about the inverted yield curve, SAHM rule, or what have you. Instead of listening to the market, they resisted it. I know a lot of people came into 2023 happy to just sit in cash and collect 5%. Ok, great. You made your 5% but you missed out on 25%. And it wasn;t just the mag 7. There were plenty names in consumer discretionary and elsewhere that did well. European and Japanese stocks also had a great year. Now what will all these folks do if interest rates start getting cut while the market is making new all time highs? At first they will resist because the market is "too high" but eventually they will do what they always do and find some rationalization to get back into the market. Rates can't get cut with the market at all time highs you say? Think again. Look at 2019. Look at 1995. Look at the 1980s. Rates cuts aren't necessarily the result of a recession. If it becomes painfully obvious that inflation has settled down - even in the 3% range rather than the 2% target - the Fed can't justify keeping rates at 5.5%. Furthermore, if it turns out that 3% becomes the new floor, the Fed may eventually capitulate on their 2% target.

Getting back to the coma observations; this is not the first time I wrote something like this. I did the same thing in 2011 when the market had a big scare and concluded that using the "waking up from a coma" perspective, it looked like market may just be having a major pullback after having been so strong during the previous few years. So, what would my outlook be now if I woke up from a 5 year coma and the first thing I did was look at the chart of the market? I would say that the market trend looks quite strong as it's on the verge of making new all time highs. I would say that based on experience, any asset price that makes a fresh new all time gives a powerful bullish signal which tends to lead to further new all time highs. I would also say though that the market is quite extended above its 200 DMA which leaves it vulnerable to a significant pullback and/or sideways consolidation phase.. These appear to be 2 conflicting scenarios but not necessarily. It is possible, and likely in my opinion, that we see the latter happen before the former. If we don't get a pullback/consolidation and the market does go on to make all time highs, I suspect it will be a bull trap and not have legs....at least initially. That folks is my unbiased "waking up from a coma" assessment. If I'm going to be wrong, I will likely be wrong in that the market simply marches higher relentlessly. because the all time high signal is quite powerful.

The market is currently doing what it does best which is frustrating both bull and bears a like by not budging much to the downside despite what appeared to be decent excuses to do so such as hotter than expected CPI. One thing I continue to notice is stubborn put buying. I pointed out in November how this was providing support to the market. At some point these hedgers/speculators will throw in the towel and perhaps that's when the market will see some meaningful downside.

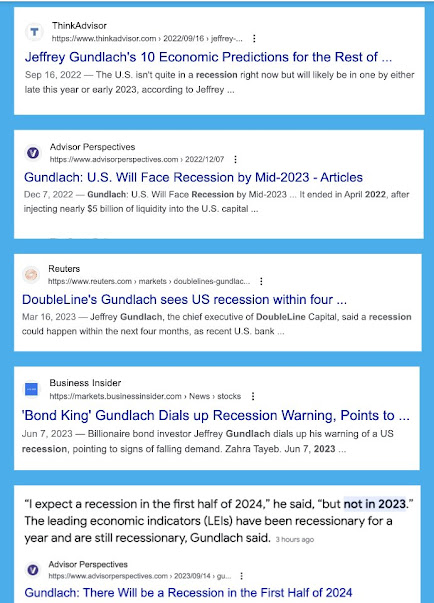

I do want to reiterate something I stated in my previous post: Despite the notion of "soft landing", the vast majority of outlooks I have read by strategists and fund managers/are NOT embracing it. You can see it by the price targets, you can hear/read it it in their discussions. This once again sets the stage for the markets to surprise on the upside this year. But unlike last year, we entered this year quite overbought with overextended CTA positioning. The market had been up for rare 9 straight weeks and now that it's stalling you are starting to see people quote ominous stats about how the first 5 days of the year of Jan are negative it bodes ill for the market and if January is negative it's going to likely be a negative year. I for one will not give much consideration to this stat because the market had been so overbought to start it and I say this without having a bias. Quite the opposite actually. I'm taking context into consideration. In January of 2018 the market started off strongly and ended the month up solidly. That would have suggested a great year was in store....we all know how that played out. Again, you had to take context into consideration. Heading into 2018 we had a complacent "global synchronized growth" narrative and signs of froth with weed stocks and BTC going parabolic.

I am not going to let me guard down, but the odds still favor another positive year based on what I'm seeing from a longer term sentiment perspective. I will show a few more charts next time which shows that the level of speculation/froth still has a ways to go before reaching bull market killing levels.